What Counts as Proof of Residency? Clarifying Common Questions

Fake proof of address should be current and clearly dated; typically issued under an individual’s own name.

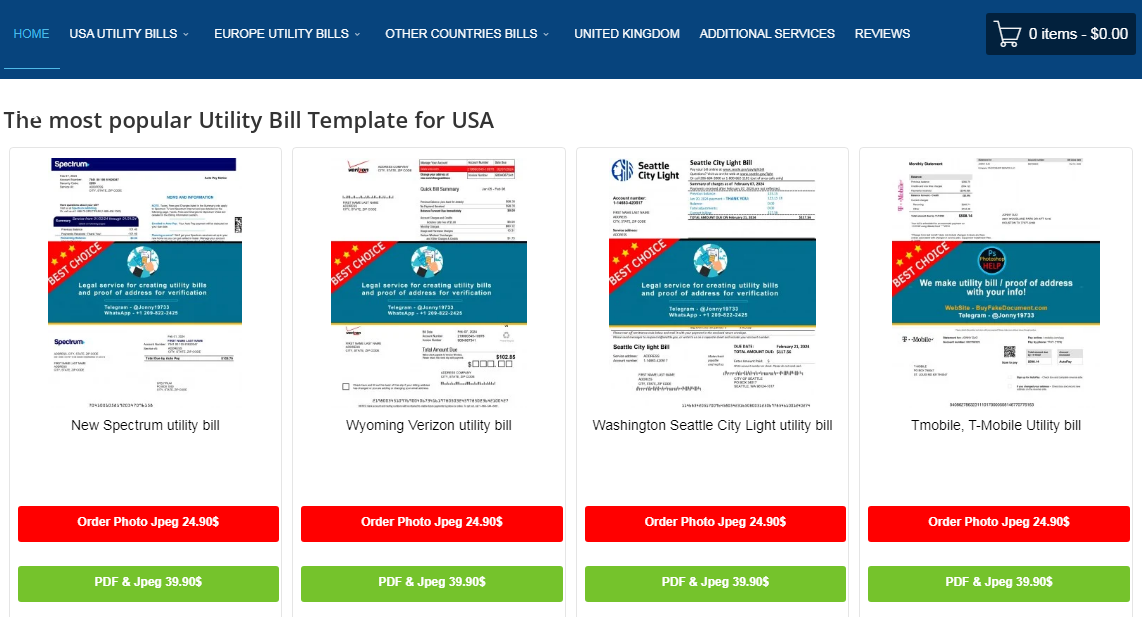

Utility Bills

Fake utility bills are documents used by individuals to provide false proof of address for various purposes. While using fake utility bills illegally can have legal ramifications, following certain tips when using them could help mitigate these risks and potentially avoid legal trouble. Firstly, ensure your privacy by never publicizing or discussing these documents publicly; secondly shred or destroy them securely once no longer necessary so as to prevent unwarranted access by third-parties.

Fraudsters use fake electric bills to fool financial institutions, lenders and banks into dispersing funds to their account instead of the intended one. These false documents can then be used when applying for loans, credit cards or insurance and sent via fax or email – fraudsters have found ways to bypass these processes by using falsified utility bills as proof of residence when applying.

Fraudsters may gain access to genuine documents by changing the name and account number on their utility bill. While this might seem harmless, changing your name can pose serious complications for an individual’s wellbeing – so before changing it it is crucial that all possible ramifications be considered carefully.

Avoid utility scams by not responding impulsively to unsolicited messages from your utilities company. If an unsolicited call, text, or email from them requests financial information – hang up and contact them directly instead of clicking any links found within these messages as this could be used by scammers to install malware on your device. Tell others about these schemes so they can help defend against these attempts at taking advantage of you!

Mobile Phone Bills

As we comb through our bank statements for overdraft fees and credit card bills for hidden charges, as well as tracking our online purchases, many people may be unaware that mystery fees can also appear on mobile phone bills without our knowledge – this practice known as “cramming” has become an increasing problem among cell phone users.

As such, consumers must remain alert and aware of these fraud techniques. They should regularly check their telephone bill for unexpected charges and call durations, while never providing personal data without first verifying it with them first.

Fraudsters have begun using fake mobile phone bills as bait to gain entry to consumers’ accounts. A fraudster may contact the victim and pose as an employee from their provider before offering discounts supposedly provided under government cost of living schemes; these discounts only apply to new contracts; existing ones cannot receive them.

As a result, many individuals are becoming victims of scams, incurring significant financial loss as a result. Some even fall into legal trouble unwittingly paying unjust charges reported to authorities. Unauthorized charges can have serious repercussions for both credit scores and reputation. Consumers should remain alert, reporting any suspicious activities to both their telecom service providers and local authorities immediately. Furthermore, they must use secure platforms when communicating with service providers. UtilityID is a cloud-based identity verification solution that enables customers to use utility bills and records as proof of address documents for faster onboarding, automated address checks, improved compliance monitoring and fraud prevention and increased success with onboarding processes.

Driver’s License

Fake driver’s licenses are false IDs created without government sanction that mimic the appearance of genuine driver’s licenses, usually used to fool law enforcement officials and gain entry to programs and events requiring valid ID. Unfortunately, in most states it is now illegal to make or possess fake driver’s licenses – if caught possessing them you could face arrest, significant fines, or even prison time.

With computer and color printer technology, creating realistic-looking fake IDs has never been simpler. Templates of state drivers’ licenses can be found online, enabling people to make money by providing false identification cards to others. Some fakes can even duplicate bar codes found on credit and ATM cards and someone’s driver’s license number (based on an intricate system called Soundex System).

Forgery is an extremely serious crime that affects not only individuals, but businesses as well. It can damage a company’s reputation as well as lead to its revenue being diverted elsewhere and customers leaving. Therefore, significant penalties should be applied against anyone caught producing false proof of address documents in order to deter potential perpetrators of these offenses.

Police officers, bartenders, store clerks and other workers have become adept at recognizing fake IDs. Furthermore, many states have implemented security enhancements for real IDs including UV imaging and laser embossing to raise plastic on the front of documents – two techniques difficult for home printers to replicate; additionally it makes verifying ID validity straightforward by comparing an ID to its state-issued book.

Residence Permit

Residence permits are legal documents that allow people to live temporarily in another country for a specified duration, with differing rules depending on your region and usually providing rights for working or studying activities. A residence permit can also serve as proof of address by simply adding your correct name and date of birth to its pages.

Always contact the bank for more detailed information regarding which documents they consider valid as proof of address verification documents. Each bank may have specific rules and regulations concerning which proof-of-address documents they accept as valid proofs of address verification documents.

Banks will typically only accept proof of address documents issued by an official agency, while others might require documents that were issued within three months.

Banks generally only accept official-looking documents, such as handwritten or heavily detailed personal ones that contain lots of personal details. Finally, it is crucial that proof of address documents be clear and easy to read.

When users submit proof of address documents to iDenfy for verification, our specialists manually extract address data from it and compare it against various databases in order to confirm its legitimacy and reduce fraud risk. iDenfy specialists continually strive to enhance identity verification and address validation processes to ensure only legitimate documents are submitted for validation, as well as improving them to ensure user claims are accurate; this is especially essential when dealing with AML compliance, KYC processes or Age and Location Verification processes.

Rental Agreement

As a landlord, it is imperative to screen applicants thoroughly in order to avoid tenant fraud and other property loss. One effective method for combatting fraudulent tenants is verifying proof of address documents accurately. Although this process may seem time consuming and unnecessary, verifying them could actually lower risks of identity theft while simultaneously decreasing fraud risks.

Proof of address documents are frequently required by banks, financial institutions and online payment management platforms to validate an individual’s address and identify whether their bank account has been accessed by someone other than themselves. Unfortunately, however, such documents are often falsified or falsified by unscrupulous individuals in order to access someone else’s funds – but often forgery is still common practice with regards to proof of address documents.

Although fake proof of address documents are unfortunately quite prevalent, there are ways to identify them more quickly. For instance, if the document does not come directly from an employer or government agency it could be suspect; additionally if there are grammatical or spelling mistakes prevalent throughout, then that too could indicate its falsity.

An additional way of verifying the validity of a proof of address document is through cross-examining it with other evidence. You might ask an applicant for copies of their pay stubs and bank statements and check for variance in dates; any discrepancies should raise red flags.

Failing to submit legitimate proof of address documents can have serious repercussions for an individual, including damaging their credit history and incurring fines or penalties that violate federal laws. Therefore, it is crucial that they abide by all legal regulations when filing their HRA claims.